Imagine waking up on your own private island with the sound of waves and the warm sun shining down. This dream can become a reality in Vanuatu, a beautiful island nation known for its stunning landscapes and friendly people.

Buying an island in Vanuatu is not just about owning a piece of paradise. It can also offer practical benefits like second citizenship, giving you and your family more travel freedom, privacy, and security.

In this article, you’ll learn everything you need to know about buying property in Vanuatu, including an island! You’ll also discover how you can take it a step further by acquiring Vanuatu citizenship and a passport through investment. Read on!

Why Choose Vanuatu for Island Investment and Living?

One of the key foundations of a successful business is diversification. Vanuatu offers an ideal opportunity for this, providing investment prospects in a growing market along with the benefits of dual citizenship and a second passport.

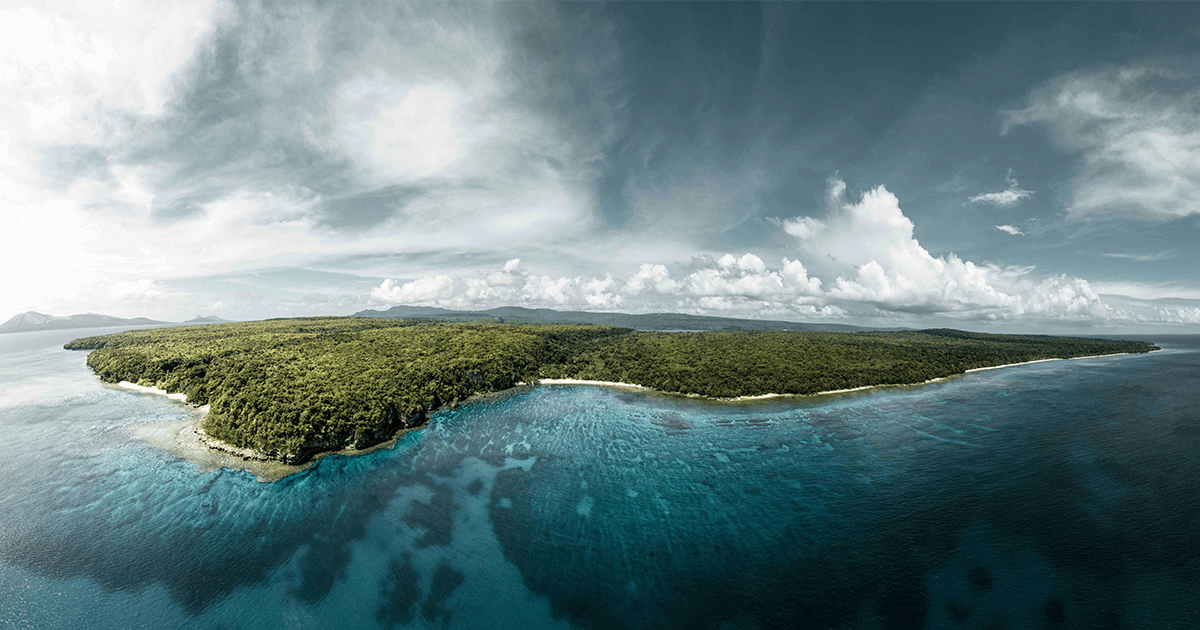

What’s not to like about Vanuatu? It is a tropical paradise with lush greenery, pristine beaches, and clear blue waters. It's a perfect spot for those who dream of owning an island or a waterfront property and enjoying the additional benefits that come with it.

Here are a few reasons why Vanuatu stands out:

- Stunning Scenery — Enjoy breathtaking views and a warm, tropical climate year-round.

- Friendly Locals — The Ni-Vanuatu people are known for their hospitality and welcoming nature.

- Tax Benefits — Vanuatu has no income tax, company tax, capital gains tax, or withholding taxes, making it a great place for investors.

- Safety and Stability — Vanuatu is politically stable with a low crime rate, providing a safe environment for you and your family.

Related Read: 23 Reasons Why Vanuatu Citizenship is a Great Option for Investors

You can also apply for Vanuatu citizenship and a passport through investment, which is another significant perk. Vanuatu citizenship offers visa-free or visa-on-arrival access to over 100 countries. Most importantly, it provides security through a second passport, offering a reliable backup plan and peace of mind for your family.

Understanding Property Ownership in Vanuatu

Before you buy an island in Vanuatu, it's essential to understand the unique property ownership system:

- Land Tenure: All rural land in Vanuatu is owned by indigenous custom owners, while urban land belongs to the government. As a foreigner, you can acquire land through a leasehold title, where the lessor is either the custom owner or the government, and you, the investor, are the lessee.

- Lease Duration: Leases typically last for 75 years in rural areas and 50 years in urban areas.

- Title Verification: It's crucial to verify the validity and standing of the title before purchasing. Engaging real estate agents with legal expertise or a recommended Vanuatu lawyer can help ensure everything is in order.

Understanding these basics will help you navigate the property market in Vanuatu more effectively and make informed decisions about your investment.

Steps to Buying an Island in Vanuatu

Step 1: Research and Select an Island

Start by conducting thorough research to identify the island that best suits your needs and preferences. It's crucial to consider factors such as location, size, accessibility, and development potential.

Step 2: Engage Legal and Real Estate Experts

Hire professionals with expertise in Vanuatu's real estate market to assist with title verification, legal paperwork, and navigating the purchase process. These experts can help ensure that your chosen property has a clear and valid title. Work with real estate agents who have professional legal experience or can recommend a reputable Vanuatu lawyer.

Step 3: Financing Your Purchase

Several banks in Vanuatu offer loans for purchasing property, including BSP (Bank South Pacific), ANZ (Australia and New Zeland Banking Group Limited), BRED (Banque Régionale d'Escompte et de Dépôt), and others. Be sure to explore different financing options and understand each bank’s interest rates and terms.

Ensure all necessary disclosures for the Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Act are submitted to facilitate the transfer of funds from overseas without limitations.

Costs Involved in Buying Property in Vanuatu

When buying an island in Vanuatu, it's essential to be aware of the various costs involved to ensure a smooth transaction and avoid any surprises.

Purchase Costs

The primary costs include stamp duty and registration fees, which amount to 7% of the purchase price. Additionally, you may need to cover legal and conveyancing fees, which vary depending on the complexity of the transaction and the professionals you hire.

Ongoing Costs

After purchasing the property, there are several ongoing costs to consider. These include yearly land rent, which varies depending on the zoning (residential, commercial, etc.) and the property's location.

In urban areas, municipal charges or rates may apply. You will also need to budget for utilities such as electricity, gas, and water, which can vary based on whether the property is in an urban or rural location.

There is no property ownership tax. However, when purchasing a property, there is a stamp duty and registration fee of approximately 7% for residential properties and a 12.5% VAT for commercial properties.

For rental income:

- Individuals renting out their property pay a 12.5% tax on rental income exceeding VT 200,000 over a six-month period.

- Companies pay a 12.5% tax on all rental income.

Take It Further by Investing in Vanuatu’s Citizenship

Buying a property or an island in Vanuatu is just the first step. This investment opens the door to a luxurious and tranquil lifestyle. To fully capitalize on this opportunity, invest in Vanuatu’s citizenship and passport. This will not only amplify the benefits of your property investment but also provide you with unmatched advantages in travel, business, and personal security.

Vanuatu's Citizenship by Investment program allows investors to gain second citizenship, offering various perks and benefits.

The program generally requires one of the following:

- An investment in a fund, such as the Cocoa Sustainable Fund, with a minimum investment of USD $155,000 for a family of four.

- A donation to the Development Support Program (DSP) of USD $130,000 for a single applicant.

Consult with us so we can guide you through the requirements and help you navigate the application process.

The Next Steps…

Owning an island in Vanuatu isn’t just a dream; it’s something you can actually achieve. With its amazing natural beauty, welcoming community, and great investment opportunities, Vanuatu is an ideal place to start a new chapter in your life.

Our team at High Net Worth Immigration has extensive experience in Vanuatu’s property market and citizenship programs. We’re ready to provide you with detailed information and personalized advice to ensure you make the best investment decisions.

We can help you with:

- Property/island selection

- Legal assistance

- Citizenship by investment application

- Ongoing support.

By choosing us, you’re partnering with experts who are dedicated to making your dream of owning an island in Vanuatu a reality. Contact us today to get started.